#GrowYourLife #BuildYourBusiness

Life Area: Financial | Topic: Taxes

Millennial “Coach Dad” Helps You With Your Taxes

With the July 15th COVID-extended tax deadline fast approaching, I wanted to put on my “Coach Dad” hat and give my Millennial/small business clients out there some peace of mind…

While filing your taxes may not be as simple as a line my daughter always quotes…

“I don’t know what the big deal is about filing taxes…

you just gather all your stuff and hand it to your Dad!”

…I do recognize that each tax situation is personal and subject to individual circumstances, but it can be even more overwhelming if you are a small business owner or self-employed.

Now, before I jump in, let me state that I am not a CPA or other tax professional and that what I write here is for informational and educational purposes only and comes to you from my years of personal experience. I recommend that you seek professional tax advice before filing your return.

First off, let me acknowledge that filing taxes is unsurprisingly one of the main sources of stress we all experience. In fact, a recent survey identified getting stuck in line at the DMV, being trapped in the middle seat of a plane, and undergoing major dental work as LESS stressful than doing taxes! I used to feel the same way.

When it comes to small business owners, freelancers, and self-employed, the IRS itself acknowledges that those taxpayers “face a particularly bewildering array of laws” regarding compliance, so many entrepreneurs put off taxes until the last minute, and then do it only as a necessary evil. But it doesn’t have to be that way:

Let me recommend you shift your mindset about taxes.

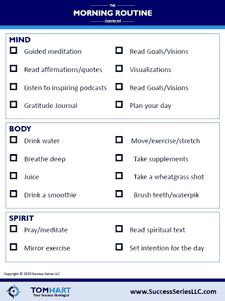

Do so by knowing two things: ❶ if you keep records as you go, you can save yourself a lot of grief, and ❷ you don’t need to know it all.

❶ By keeping accurate records as you go, you will have the best chance of maximizing your deductions and minimizing your taxable income. You can also more accurately project at any time of the year what your likely year-end revenue and expenses will be and therefore more accurately calculate your quarterly estimated payments (1040ES). Maintaining your own records helps keep you in control. Plus, it’s easy to do. You can create a simple spreadsheet or use affordable, cloud-based accounting software designed for self-employed professionals. My team and I use Quicken.

Time and money are the most common expenses for most freelancers. Effectively tracking your time usually produces more billable hours, which enables you to earn what you’re really worth. Here, too, you can use a basic spreadsheet or find cloud-based solutions. Many options for the latter also can generate invoices to keep you and your clients accountable. My daughter loves to use FreshBooks for her marketing agency, iHartMarketing.com.

Tracking your time and expenses has other benefits as well. You’ll be able to see how productive you are by project or client. Come filing time, you more easily can spot patterns and categorize expenses that appropriately reduce your taxable income. This includes the money you’re spending on advertising, business supplies, business insurance, gas, conferences, professional services, and travel. In short, you’ll have all the information you need to protect yourself from overpaying.

❷ And for the “you don’t need to know it all” part: there are many software alternatives out there, like TurboTax, that will walk you through the mechanics of your return in an interview kind of way. And, if you’re beyond that, just choose the “Forms” format and select what you need to file your return. This is especially helpful after you have a few years of filing under your belt and not much has changed with business operations in the meantime. Just merge in your last year’s return and take it from there.

Most self-employed professionals do not need an accountant or bookkeeper to manage their year-round finances. Those internal finance roles are more appropriate for small businesses with complex sales-tax issues, payroll, or other advanced reporting requirements. However, partnering with a professional at tax time is a smart move. If you’ve done the work to keep track of your income, taxes paid and business expenses, a tax expert can make the actual filing virtually painless. He or she can also identify potential deductions to track in the future, reducing your taxable income for years to come.

Taking control of your taxes removes one of the biggest barriers to sustained and successful financial independence. It also opens the door to start thinking about other ways to maximize your success — such as examining whether an LLC or S-Corp structure makes the most sense and how you can incorporate retirement planning into each model. Peruse this website to find my many FREE resources to help you Grow Your Life and Build Your Business.

Please share this post with your family and friends.

My mission is to inspire people and organizations to live their highest vision.

My mission is to inspire people and organizations to live their highest vision.

I am a Success Strategist and Master Coach. I provide transformational coaching and training for individuals and organizations to help you Grow Your Life and Build Your Business by getting clear and focused on what you want, why you want it, and how to create it. Learn more about me at SuccessSeriesLLC.com.

There is no better endorsement than that of a friend, so if you like what you’re reading or are using my many FREE resources, tell a friend to join the Tom Hart Success Series Community, to receive email notifications of new blog posts and Talk with Tom podcast episodes, learn of upcoming events, and other news, by visiting my website and clicking on the offer to receive my FREE monthly resource by leaving their email address OR forward this to them and have them simply click here (we respect your privacy and do not tolerate spam and will never sell, rent, lease or give away your information to any third party).